Mastering Market Trends: Uptrends, Downtrends, and Sideways Movements Explained

You probably know that you can make money in the stock market in two main ways. The first one is by investing. When we invest, we’re thinking long-term. We believe that the stocks we buy today will grow in value over time and pay us dividends regularly.

Alright, let’s make it more conversational.

Mastering Trading: Strategies for Quick Profits in the Stock Market

Now, what about the other way? It’s called trading, and it’s the second method. If you’ve ever bought and sold stocks quickly, then you’ve traded before. And there are different types of trading, like swing trading, options trading, and day trading.

So, today’s topic is all about trading. When we talk about trading, we’re looking at making quick profits in the stock market. Here’s the thing: traditional fundamentals like how well a company is managed, how much cash it has, or its assets and liabilities don’t really matter in trading. Even ratios like the P/B ratio or P/E ratio don’t have much impact. So, what does matter then? What’s the key to success in trading? That’s what we’re diving into today.

Trading Tips: Learn How to Navigate the Stock Market Safely

Here’s what you’ll be learning today. But, before we dive in, I’ve got to give you a heads up: trading requires some technical analysis skills. Now, listen up—while it’s possible to make quick cash in the stock market, it’s not a guaranteed thing. Trying to make fast money can quickly turn into a gamble. Investing without knowing what you’re doing is basically leaving everything to chance. You’re just crossing your fingers and hoping for the best. But let’s face it, relying solely on luck isn’t a sustainable strategy. Sure, you might get lucky once in a while, but it’s not something you can count on every time. Plus, every time you jump into the market, there’s a risk involved.

I want to assure you that you’re going to gain some valuable knowledge here. I’ll break things down for you in simple terms so that you can start to anticipate how the market moves. I’m talking about making it so clear that even an eighth-grader could understand whether prices are going up or down. But hey, there’s always more to learn, right?

After going through all this, you might feel like I’ve become your stock market adviser, but let me be clear: I still want to give you a heads-up. If you’re new to all this and you dive into trading without knowing what you’re doing, it’s like playing a game of chance. However, if you take the time to learn the ropes, you could turn trading into a profitable venture within just a day or two.

Listen, here’s the deal: making big gains in investing doesn’t happen overnight. It’s more like a marathon than a sprint. It takes time—like five, ten, or even fifteen years—to really show your skills in growing your money through compounding and smart trading. That’s why patience and persistence are key.

Master Stock Trading: The Ultimate Guide to Paper Trading for Beginners

Start with paper trading. A lot of folks might tell you to skip this step, but I say go for it. It’s like practicing without risking any real money. Instead of using cash, jot down your trades on paper. You’ll keep track of what’s working and what’s not. For example, if you think a stock is going up, write it down and see how it plays out. Sure, you might feel a bit foolish at first—like everyone who’s ever tried something new. But hey, that’s how you learn, right? You’ll pick up valuable lessons from other people’s mistakes along the way. Consider this my little heads-up to you. Now, let’s dive into it. We’re about to get into technical analysis. Absolutely, I’m here to simplify things for you, so let’s take it step by step. We’re starting from scratch, assuming you’re brand new to this.

Decoding Stock Market Trends: Uptrend, Downtrend, and Sideways Movement Explained

Remember, when it comes to trading, what matters most is the short-term trends, not the long-term outcomes. You’ll be looking at a lot of data, but right now, the trend is the key focus in technical analysis. The crucial part is identifying which direction the market is currently moving in. Understanding patterns is key here. If a trend keeps pushing prices up, chances are that… Let me give you another example to make things clearer. Imagine you hop on a train that’s headed from Delhi to Pune, and you catch it halfway through, say, from Gwalior. Well, you’re going to end up in Pune because that’s where the train is headed.

Think of it like this: the train’s direction is like the market trend. If the train’s going from Delhi to Chandigarh instead, you’ll get off at Chandigarh. But if the trains stuck on the tracks and not moving at all, well, you’re not going anywhere.

Understanding Market Trends

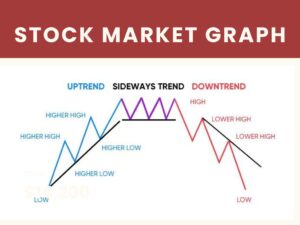

Now that I’ve given you an example, let’s break it down a bit. It’s important to understand these trends I mentioned. So, what are these trends exactly? Well, there are three main types in the stock market.

Uptrend

First up, we have the uptrend, which is probably the one you’ll come across most often. Picture a graph moving upwards—that’s an uptrend. It means the market is expanding and heading in an upward direction.

Downtrend

Next, we’ve got the downtrend. This one’s pretty straightforward. When prices start dropping consistently, that’s a downtrend. It’s like the opposite of the uptrend.

Sideways Trend

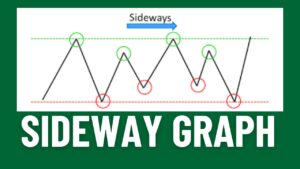

And then, there’s the sideways trend. This one’s a bit different. Instead of prices going up or down, they kind of just move sideways within a certain range. It’s like the market’s stuck in a zone, neither rising nor falling. Imagine this as the area where prices are just bouncing around without any clear direction.

Alright, let me break it down for you. Picture this: I’m writing to you at this moment, and I understand that it might not click right away. That’s okay; I’m here to explain.

Think of this line as representing both the support and the resistance in the market. Now, let’s talk about what’s happening. The prices are kind of just hovering around here, neither going up nor down dramatically. It’s like they’re chilling in their comfort zone. We call this a sideways trend.

Now, if you’re trading options during a sideways trend, you might end up losing some money. Why? Because the prices aren’t really moving much, which means your option loses some of its value over time due to theta decay. It’s like the option is losing a bit of its worth because things aren’t changing much in the market.

Let me put it in simpler terms for you. Imagine you’re at a store, and you tell the shopkeeper you’ll buy a phone from him in a week, no matter the price. But when the time comes, if the price has gone up, you’re still only willing to pay what it’s worth now. So, essentially, you’ve given the shopkeeper a little extra money upfront as a kind of “promise fee.”

Now, if you happen to show up a week early, even just a day before the agreed time, the shopkeeper might say, “Hey, you owe me a bit less now, just 100 rupees.” Why? Because there’s a better chance you know the current price.

Remember when I mentioned theta decay earlier? It’s like this: as you gain more experience, you’ll understand it better. It’s basically the idea that options lose some of their value over time, especially if nothing much is happening in the market.

Understanding Stock Market Trends: Higher Highs, Lower Lows, and Sideways Movements Explained

Let me simplify this for you. Think of it like this: imagine you have a line that represents the ups and downs of the market. When that line goes up really high, we call it a “higher high.” And when it dips down, it’s like a “lower low.”

Now, let’s talk about when it goes from high to low. The low point it reaches isn’t just any low; it’s the lowest point of the higher side. So, we call it a “higher low.”

Now, when the trend starts going down, we call it a “downtrend.” And as it falls lower, we call the high points of that downward trend “lower highs.”

So, to sum it up: higher highs, higher lows, lower highs, and lower lows. Got it so far?

Now, when the prices are kind of just moving sideways without any major up or down movements, that’s a “sideways trend.” It’s like the market’s just cruising along without any big changes.

Remember, it’s crucial to pay attention to these trends.

Trading During Downtrends

Let me break it down for you. When the market is on a downward slide, there’s a chance to make some profit with option trading if you invest in what’s called a “put option.” This works best if you spot that downward trend early on. So, being able to recognize the trend is super important.

Got it? Awesome! You’re catching on fast.

Conclusion

Mastering market trends is essential for successful trading. By understanding uptrends, downtrends, and sideways movements, you can make more informed decisions and increase your chances of making profits. Remember, trading requires patience, persistence, and continuous learning. Start with paper trading to build your skills, and always keep an eye on market trends to navigate the stock market safely.

Happy trading!

FAQs on Stock Market Trading

1. What is the difference between investing and trading in the stock market?

Answer: Investing involves buying stocks with the expectation of long-term growth and dividends, often holding them for years. Trading, on the other hand, focuses on short-term gains, buying and selling stocks within a short period, such as days, weeks, or even minutes.

2. What are the main types of trading?

Answer: The main types of trading include:

- Day Trading: buying and selling stocks within the same trading day.

- Swing trading: holding stocks for several days or weeks to profit from expected price swings.

- Scalping: making numerous small trades to capture tiny price movements.

- Options Trading: Buying and selling options contracts based on the expected price movement of underlying stocks.

3. What are candlestick charts, and why are they important?

Answer: Candlestick charts are a type of financial chart used to represent the price movements of a security. Each candlestick shows the open, high, low, and close prices for a specific period. They are important because they help traders analyze market trends and make informed trading decisions.

4. What are uptrends, downtrends, and sideways trends?

Answer:

- Uptrend: When the price of a stock consistently rises over a period, creating higher highs and higher lows.

- Downtrend: when the price consistently falls, creating lower highs and lower lows.

- Sideways Trend: When the price moves within a range without significant upward or downward movement.

5. What is technical analysis?

Answer: Technical analysis involves studying past market data, primarily price and volume, to predict future price movements. Traders use various tools, like charts, indicators, and patterns, to identify potential trading opportunities.

6. How does one start with paper trading?

Answer: Paper trading involves simulating trades using a virtual account without real money. It helps beginners practice and develop their trading skills without financial risk. Many brokerage platforms offer paper trading accounts.

7. What is theta decay in options trading?

Answer: Theta decay refers to the reduction in the value of an option contract as it approaches its expiration date. The closer the expiration, the faster the option loses value, especially if the market remains inactive.

8. What are the support and resistance levels?

Answer:

- Support Level: A price point where a stock tends to find buying interest as it falls, preventing further decline.

- Resistance Level: A price point where a stock faces selling pressure as it rises, preventing further increases.

9. What are the risks of trading?

Answer: Trading involves several risks, including market risk, liquidity risk, and leverage risk. Prices can move against your position, leading to losses. It requires careful analysis, risk management strategies, and staying informed about market conditions.

10. How can I manage risk while trading?

Answer: Effective risk management strategies include:

- Setting stop-loss orders to limit potential losses.

- Diversifying your portfolio to spread risk.

- Using only a portion of your capital for trading means not risking more than you can afford to lose.

- Continuously educating yourself and staying updated on market trends.